Ponder this:

"In 2007, just before the financial crisis, Iceland’s average income was the fifth highest in the world, 60% above US levels... Icelanders werethe happiest people in the world, according to an international study in 2006 (WorldDatabase of Happiness, 2006). They also had one of the least corrupt public administrations in the world, according to Transparency International."

18 months later things weren't so rosy

Iceland's banking sector began to grow rapidly from 2003 when state-run banks (Kaupthing, Landsbanki, and Glitnir) were privatized, the Icelandic government also decided not to tap international banks/investors to help with the transition, instead individual domestic entities gained controlling interests in the banks. The privatization of the state banks also heralded liberalization of interest rates and free flow of capital in international markets, which meant they could fully capitalize on money market funding, and open overseas branches abroad.By 2004 Iceland’s banks were competing directly with the HFF, which had been the major provider of mortgage loans. The banks did this by offering loans with lower rates, longer maturities, and higher LTVs.

In addition, the banks offered equity release mortgages/loans allowing homeowners to refinance existing mortgages and withdraw equity in their homes for consumption or investment purposes. These measures spurred an expansion in credit and caused real estate prices to soar. (Fierce competition led to a negative spreads. One of the major savings banks, for example, financed itself via long-term bonds paying 4.90% to 5.20% but at the same time lent its customers money to finance real estate at 4.15%).

This liberalization coupled with a benign international macro backdrop meant that the Icelandic grew at a brisk clip going into 2004 to 2006 fuelled by a consumption boom and a booming real estate market.

Just to egg on the consumption boom further the government also cut income tax rates for individuals one percentage point a year for three years running until 2007 and also lowered VAT (sales tax) on food products and other products. (More Range Rovers were sold in Iceland in 2006 than collectively in the other Nordic countries combined - to put that in perspective the population of Iceland is approx 300,000 or less than a tenth of Norway's, the smallest of the Scandinavian nations!)

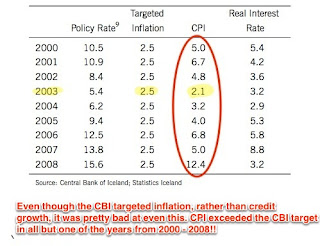

However, the economic boom led to rising inflation. The Central Bank of Iceland (CBI) began tightening monetary policy in an attempt to curtail inflationary pressures; between 2004 and 2007, it raised nominal short-term interest rates from 5% to 15%. Tighter monetary policy though was perceived by the market as akin to a CBI put option on the krona and fuelled carry-trading and demand for Krona bonds among investors, this placed further upward pressure on the value of the krona and worsened the deteriorating current account/trade deficit (something which the CBI seemed oblivious too).

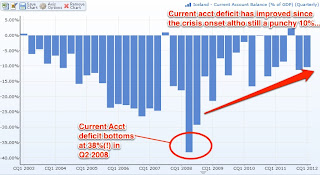

The current account deficit increased every year from 2002 to 2008 and by 2007 was at a ridiculous 26% of GDP. Some of the build up can be attributed to a decision in 2003 to build the Kárahnjúkar power plant and Fjarðaál aluminium smelter, however, a substantial portion was due to capital inflows to finance carry trades/arb interest rate differentials and buy imported goods. Moreover, the savings ratio of Iceland was negative during the boom years, 2003 to 2007.

The current account deficit increased every year from 2002 to 2008 and by 2007 was at a ridiculous 26% of GDP. Some of the build up can be attributed to a decision in 2003 to build the Kárahnjúkar power plant and Fjarðaál aluminium smelter, however, a substantial portion was due to capital inflows to finance carry trades/arb interest rate differentials and buy imported goods. Moreover, the savings ratio of Iceland was negative during the boom years, 2003 to 2007.

Icelandic banks and companies found it easy to issue foreign currency bonds/debt overseas or take on overseas denominated loans to exploit the lower rates and the tailwind of ISK appreciation. (In 2004, approximately 20-30% of foreign-denominated lending was directed towards firms with no offsetting foreign revenues, i.e. they were exploiting the advantageous carry and creating a growing FX mismatch between liabilities and revenues.)

By August 2005 foreign banks/issuers began to jump onto the bandwagon issuing ISK bonds to overseas investors. All this led to further ISK appreciation and made imported good cheaper… aggravating the current account etc etc. Higher demand for ISK also led to lower borrowing costs, ergo more issuance and demand, a stronger krona, easier repayment for issuers (and Icelandic consumers) and away we go again.

Moreover, as competition heated up in the housing market for mortgages lenders did not follow the CBI and start hiking their own rates (the HFF was also keen to recapture market share that the banks had been taking off it). Thus the real effective rate collapsed, which further pushed up demand for housing and inflated Icelandic residential prices. In addition, since commercial banks were willing to make loans based on a house's equity, rising equity values allowed consumers to refinance and assume higher levels of (debt-fueled) consumption.

2006 Geyser Crisis

By 2006 Iceland's current-account had swung to a deficit of 16.1% of GDP from a 1.6% surplus in 2003 and at the end of 2005, interest rates for the Icelandic banks also started rising as questions about the funding stability of short-term money markets and their impact on the Icelandic banks began to be raised, particularly regarding their ability to roll-over/refinance their large foreign currency liabilities.

Merrill, Danske Bank and the IMF all wrote critical reports about the macro situation in Iceland and in February 2006 Fitch downgraded Iceland’s outlook from stable to negative.

The krona fell sharply, the value of banks’ liabilities in foreign currencies rose, the stock market fell and business defaults rose, and the sustainability of foreign-currency debts became a public problem. The big three were forced to pay higher spreads than other European financial institutions in the same risk group in the wholesale market, which pretty much shut them out of wholesale funding: debt securities in issue in the European market shrunk to just over EUR4bn in 2006 from about EUR12bn in 2005. (A March 2006 Merrill's report noted the Icelandic banks paid 50 points above similar European Banks for funding.)

In theory, 2006 should have been the wake-up call for the banks and authorities to start sorting out the maturity and currency mismatches within the system and get a handle on the blow out in balance sheet size of the big three lenders.

Instead, the lesson the lenders and authorities took away was completely the reverse and it just accelerated the madness. With a mature domestic market the banks looked abroad to keep fuelling the balance sheet expansion (by 2006 Iceland's banks balance sheets were equivalent to over 700% of GDP and up from less than 200% in 2003!).

The krona fell sharply, the value of banks’ liabilities in foreign currencies rose, the stock market fell and business defaults rose, and the sustainability of foreign-currency debts became a public problem. The big three were forced to pay higher spreads than other European financial institutions in the same risk group in the wholesale market, which pretty much shut them out of wholesale funding: debt securities in issue in the European market shrunk to just over EUR4bn in 2006 from about EUR12bn in 2005. (A March 2006 Merrill's report noted the Icelandic banks paid 50 points above similar European Banks for funding.)

In theory, 2006 should have been the wake-up call for the banks and authorities to start sorting out the maturity and currency mismatches within the system and get a handle on the blow out in balance sheet size of the big three lenders.

Instead, the lesson the lenders and authorities took away was completely the reverse and it just accelerated the madness. With a mature domestic market the banks looked abroad to keep fuelling the balance sheet expansion (by 2006 Iceland's banks balance sheets were equivalent to over 700% of GDP and up from less than 200% in 2003!).

RELATED PARTY LENDING

As mentioned earlier, the Icelandic authorities eschewed cornerstone foreign investors/financial institutions coming in to take stakes in the liberalized banking sector so control of the lenders wound up in the hands of local entrepreneurs who in the best tradition of poor lending controls used the banks to bankroll their commercial empires.

(Tony Shearer, who was CEO of the British bank Singer and Friedlander when Kaupthing took it over, was shocked when he started looking into his new employer’s books. The bank had only one board member who was not Icelandic and all directors were granted loans to buy shares in the bank.)

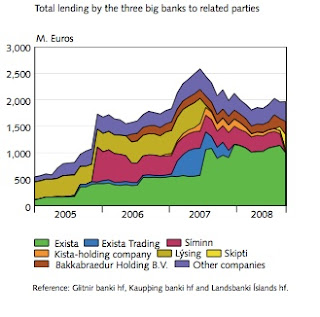

The banks had large exposures (which really took off after 2006) to investment groups/holdco's (usually owned by their controlling shareholder) and to each other (via shareholdings)… notice any similarities with the Korean Chaebol & merchant banks or Turkish private banks?

(Tony Shearer, who was CEO of the British bank Singer and Friedlander when Kaupthing took it over, was shocked when he started looking into his new employer’s books. The bank had only one board member who was not Icelandic and all directors were granted loans to buy shares in the bank.)

The banks had large exposures (which really took off after 2006) to investment groups/holdco's (usually owned by their controlling shareholder) and to each other (via shareholdings)… notice any similarities with the Korean Chaebol & merchant banks or Turkish private banks?

As with Japan in the late 1980s, where loans were increasingly made to holding companies with the main purpose of investing in other companies the big three made loans to entities often intertwined by cross-ownership or other relations between parties in which dubious collateral was placed.

The biggest shareholder in Kaupthing Bank was Exista, with just over a 20% share in the bank. Exista was also one of the bank’s biggest debtors. Robert Tchenguiz, who owned shares in Kaupthing and Exista, had EUR2bn in loans from Kaupthing and its subs just before the lender collapsed. Notably, the bank ramped its exposure to Tchenguiz from 2007 onwards as Tchenguiz’s companies started going downhill in order for him to meet margin calls from other banks. (SEE LATER AS WELL ON GLITNIR-FL GROUP- BAUGUR)

Oh yeah, and if you didn't think they were irresponsible enough In fall 2008, while Kaupthing was in the midst of a liquidity crunch it somehow found the capital to loan key clients roughly EUR 500 million to let them sell CDS on itself!?

To finance these loans, the banks borrowed in foreign capital markets, increasing Iceland’s net external debt by 142% of GDP over the four years to end-2007.

OVERSEAS FINANCING

Oh yeah, and if you didn't think they were irresponsible enough In fall 2008, while Kaupthing was in the midst of a liquidity crunch it somehow found the capital to loan key clients roughly EUR 500 million to let them sell CDS on itself!?

To finance these loans, the banks borrowed in foreign capital markets, increasing Iceland’s net external debt by 142% of GDP over the four years to end-2007.

OVERSEAS FINANCING

Foreign deposits and short-term collateralised loans became an increasingly important source of capital for the three banks after 2006. By the end of 2007, Iceland's three largest banks relied on short-term financing for 75% of their funds, mostly through borrowing in the money markets and in the short-term interbank market.

A) European Retail Banking

With short-term money market/wholesale funding becoming expensive the banks decided to change their funding strategies. As a founding member of the European Economic Area (EEA) agreement, Icelandic banks had the right to operate within the border of other EU countries. However, until 2006 the banks never had much need to operate out of their home market.

In October 2006, Landsbanki launched Icesave in the UK, an Internet-based bank that aimed to win retail savings deposits by offering more attractive interest rates than high-street banks and was soon flooded with deposits. Millions of pounds rolled in from Cambridge University, the London Metropolitan Police Authority, and even the UK Audit Commission, as well as 300,000 retail depositors.

In October 2006, Landsbanki launched Icesave in the UK, an Internet-based bank that aimed to win retail savings deposits by offering more attractive interest rates than high-street banks and was soon flooded with deposits. Millions of pounds rolled in from Cambridge University, the London Metropolitan Police Authority, and even the UK Audit Commission, as well as 300,000 retail depositors.

At Landsbanki's insistence, Icesave was legally established as a branch rather than a subsidiary, so they were under the (more colludable) supervision of the Icelandic authorities rather than UK regulators. No one worried that, because of Iceland’s obligations as a member of the EEA (European Economic Area) deposit insurance scheme, its population of 319,000 would be responsible for compensating the depositors abroad in the event of failure.

Kaupthing also followed suit and within 18 months, the pair had amassed over £4.8 billion in UK deposits. As a group, the Icelandic banks cut their loan-to-deposit ratio to "only" 2.0x by 2007 from 3.5x in 2005. By way of comparison, have a look at the chart below on how levered the Icelandic banks were and how reliant they remained on wholesale funding for loans.

Also note most of the deleveraging of the LTD ratio came from internet deposits… who are basically yield whxres and would probably have jumped ship to anyone who was silly enough to prepare to outbid the Icelandic lenders for retail deposits. Kaupthing Edge (the bank's overseas online savings bank) was generating net inflows of ₤100–150mn/week until mid-2008.

B) Fund Management

The big three all had fund management divisions, between 2004–2008 the total AUM of the three management companies grew by over 400%, or from ISK 173 billion to 893 billion.These units however did not really begin to aggressively grow AUM until spring 2006, when European wholesale markets for Icelandic companies began to shut down due to negative publicity.

A large part of the total assets of Kaupthing’s Money Market Fund was used to invest in the parent company and undertakings related to it. During the latter half of 2006 this ratio was about 50% of the total assets of the fund and significantly higher in 2008. (At end 2007 bonds of Exista - Kaupthing's largest shareholder - alone were 20% of AUM! Talk about concentration risk!!) Note also that this was labeled a money market fund yet between 2006-08 it rarely invested in government securities and both NIBC and Norvik bank were securities of foreign banks, both banks were related parties and shared large shareholders.

Landsvaki’s Corporate Securities Fund invested in a bond issued by Björgólfur Guðmundsson (a major Landsbanki shareholder), against the will of its fund manager!

A large part of the total assets of Kaupthing’s Money Market Fund was used to invest in the parent company and undertakings related to it. During the latter half of 2006 this ratio was about 50% of the total assets of the fund and significantly higher in 2008. (At end 2007 bonds of Exista - Kaupthing's largest shareholder - alone were 20% of AUM! Talk about concentration risk!!) Note also that this was labeled a money market fund yet between 2006-08 it rarely invested in government securities and both NIBC and Norvik bank were securities of foreign banks, both banks were related parties and shared large shareholders.

Landsvaki’s Corporate Securities Fund invested in a bond issued by Björgólfur Guðmundsson (a major Landsbanki shareholder), against the will of its fund manager!

C) Glacier Bonds & CDOs

The glacier bond market boomed and by spring 2007 $6.3 billion of these bonds were outstanding - equivalent to almost 37% of Iceland's GDP - and juiced the liquidity (and liabilities) of the banks. Meanwhile, another source of regulatory/ratings arbitrage opened up: collateralized debt obligations (CDOs). Icelandic debt on paper at least had decent ratings (even if the European market was demanding higher spreads), so these could be taken into the US securitization market and bought for cheap (given the higher yield demanded by the market) and thrown into CDOs to up the rating. This way, almost EUR6bn was borrowed in the American credit market.D) Foreign Currency Loans

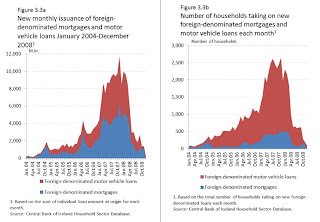

Households went full guns blazing into the carry trade after the Geyser crisis: JPY and CHF loans went from accounting for around 2% of overall lending to households at the beginning of 2006 to accounting for close to 20% by the time the banks fell in 2008. (Admittedly, going into late 2007 the banks wised up and started shutting down FX loans thus the tail-end of the increase in 2008 from 13% to 20% of loans was due to the weakening of the ISK.) Theoretically, FX loans were safe for banks, as the loans were hedged but there was the mismatch between hedge and loan maturity so this only provided short-term security. Moreover, while the banks may have been hedged to some degree their customers weren't and, therefore, write-downs became inevitable.

THE MELTDOWN COMETH

In 2H 2007, FL Group (now reborn as Stodir), a large Icelandic investco/holdco with a large stake in Glitnir and itself 20% owned by Baugur, posted a record loss of roughly ISK80bn. ISK60bn of this loss came in Q4 and needed to raise fresh equity; a large chunk of this was met by Baugur by selling it the real estate company Landic Property. A lot of the cash call appeared to have been bankrolled by loans from Glitnir. Glitnir’s loans to Baugur and Baugur-linked entities (e.g. FL Group etc.) went from around EUR900mn in the spring of 2007 to nearly EUR2bn a year later. At its peak related party lending comprised more than 80% of Glitnir's equity.

Meanwhile, Gnúpur, a leveraged holdco with a 3.5% stake in Kaupthing and a 10% stake in FL Group, collapsed at the end of 2007. (Leveraged cross-holdings anyone?) Gnupur's implosion triggered creditor negotiations in January 2008, a stock market sell off and considerable overseas media attention abroad. This in turn adversely affected the banks funding abilities, especially Glitnir's: it cancelled a bond issue at the beginning of the 2008 because of little investor appetite.

In February 2008, Northern Rock was nationalised in the UK after a bank-run this was followed by an outflow of deposits at Icesave (Landsbanki's UK branch/sub). Then in March 2008, Bear Stearns imploded and was sold to JPM raising global investor angst over financials and a shift to risk-off, which meant the exchange rate of the krona began to fall. Icelandic investment companies had also borrowed from overseas lenders and importantly had pledged their securities as collateral.

The decline in global equity prices and the weakening FX prompted margin calls from some foreign creditors. Some of these holdco's refinanced/met their calls by punting the cash calls back to some of the Icelandic banks in which they were large shareholders, e.g. Milestone, an investco, was facing a margin call from Morgan Stanley over loans it had received to finance the purchase of a Swedish bank (Invik,later named Moderna). Milestone eventually settled the loan but did so by getting Glitnir to take over the loan. Milestone through connected parties owned 7% of Glitnir!

Finally with the great moderation drawing to a close some of the sell-side began publishing negative reports on the Icelandic financial system and the financial press began to pick up on this.

In February 2008, Northern Rock was nationalised in the UK after a bank-run this was followed by an outflow of deposits at Icesave (Landsbanki's UK branch/sub). Then in March 2008, Bear Stearns imploded and was sold to JPM raising global investor angst over financials and a shift to risk-off, which meant the exchange rate of the krona began to fall. Icelandic investment companies had also borrowed from overseas lenders and importantly had pledged their securities as collateral.

The decline in global equity prices and the weakening FX prompted margin calls from some foreign creditors. Some of these holdco's refinanced/met their calls by punting the cash calls back to some of the Icelandic banks in which they were large shareholders, e.g. Milestone, an investco, was facing a margin call from Morgan Stanley over loans it had received to finance the purchase of a Swedish bank (Invik,later named Moderna). Milestone eventually settled the loan but did so by getting Glitnir to take over the loan. Milestone through connected parties owned 7% of Glitnir!

Finally with the great moderation drawing to a close some of the sell-side began publishing negative reports on the Icelandic financial system and the financial press began to pick up on this.

EFFORTS TO STEM OFF A BANK RUN

A) Love Letters

With the wholesale market becoming increasingly reluctant to lend to the big three they needed to find a way to either refinance existing debt or settle loans. One way they did this was to use "love letters". The Big Three would sell debt securities to smaller regional banks, which took these bonds to the CBI as collateral and borrowed against them; they then lent the fresh money back to the initiating big bank, which they could then use to redeem maturing debt.

The banks also started repeating this trick overseas by establishing Luxembourg subs to which they could sell love letters to. The subs then sold them on to the Central Bank of Luxembourg (CBL) or the ECB and upstreamed the capital back to the Icelandic parent. Between February and end April 2008 (i.e., 3 months!), the big three's subs increased their borrowing from the Central Bank of Luxembourg by €2.5 billion and from between Jan 2008 to July 2008 Icelandic collateralised loans with the ECB went from €1bn to €4.5bn! Given the inter-linkages, the big three's bank debt should not have been allowed to be used as collateral against another Icelandic bank’s borrowing.

By April, the CBL and ECB asked the Icelandic lenders and authorities informally to stop taking the pxss, but this failed and the collateralised lending kept on coming until July when the CBL stepped in and forbade love letters. Quelle surprise, in fall 2008, five counterparties defaulted on their Eurosystem loans and three of these were subsidiaries of the large Icelandic banks.

B) More Overseas Branches

In September 2007, as storm clouds began to gather over the big three Landsbanki notified the Dutch authorities that it intended to establish a branch in Holland.In May 2008, Landsbanki began to receive deposits into its Amsterdam Icesave accounts in order to access cheap retail funding to refinance its debts.

END OF THE ROAD

Given the backdrop the big three were engaged in offloading their long-term assets as fast as possible in 2008. Any ISK assets were getting clobbered and as the ISK depreciated it made it harder to meet payment of maturing short-term foreign debt. Unsurprisingly, jittery UK savers also started pulling their deposits out of the local branches. Kaupthing Edge's weekly deposit inflows of GBP100-150mn reversed to GBP50mn outflows by September 2008.

With Lehman, AIG and Merrills all going tits up in September 2008 it was pretty clear that Glitnir was not going to be able to find the capital to repay or refinance €600mn maturing in October, and so on 25 September it asked the government for a bailout. Instead, the Government, on the advice of the CBI, announced on 29 September it was taking a 75% equity stake for €600mn instead… or roughly a 2/3 haircut for the other shareholders. Not too shockingly given sentiment this intensified the bank runs and led to a sovereign downgrade (implicit support of the financial sector being taken onto the sovereign balance sheet blah, blah) and that of all the major banks.

By early October, all three banks were suffering from a severe liquidity crisis and in need of CBI emergency funding. Events then unfolded in rapid succession: an emergency law was passed on October 6th allowing the Icelandic Financial Regulatory Authority (FSA) to take over operations of illiquid banks, suspend payments in order to safeguard value and protect depositors and establish new banks to assume DOMESTIC deposit obligations and assets from failing banks. On October 7 the Icelandic Financial Supervisory Authority (FME) intervened in the operations of Glitnir and Landsbanki.

Kaupthing appeared potentially viable as a going concern and had received an 80 billion ISK loan from the government on October 6 to meet short financing. However, via its UK branch (Icesave), it had 1,200 billion ISK in liabilities (deposits) and as branch (i.e. not a subsidiary) the liability for depositor protection lay with the Icelandic state. CBI comments that the Icelandic state would not meet these obligations led to the UK using antiterrorist laws to seize the UK assets of the Icelandic banks triggering loan covenants for the group and Kaupthing was put into receivership on October 9.

Unsurprisingly, the big three had all passed "stress tests" only a few weeks earlier by the (Icelandic) FSA - there was no systemic test of the overall financial system or a proper liquidity simulation in the stress tests. The banks in theory were adequately capitalized. However, the equity was of poor quality as the collateral used to underpin the equity was often equity from related parties. In some cases, loans to third/connected parties were used to finance purchases of the bank’s own shares, i.e. effectively banks were lending money to buy shares in themselves, with those shares being the only collateral!? For example, Kaupthing Bank ultimately financed a large portion of Gnúpur’s shares in Kaupthing itself.(Clearly, the scope for abuse in manipulating one's own share price by doing this is high.) Banks would also invest their own equity alongside investments of their main borrowers completely blurring the lines between creditor and debtor. In mid-2008 weak equity amounted to just above 20 % of the capital base of Glitnir (i.e. related party shareholdings etc), stripping out intangibles and the weak equity base was about 45% of the capital base! Kaupthing, meanwhile, was happy to mark up assets it bought at inflated prices, which then contributed to its capital cushion (Olam anyone?).

How fucked was the situation?

The banks' balance sheets were 11x GDP with their FX exposure about 7.5x GDP. Meanwhile, the CBI's reserves were about 21% of GDP (i.e. 0.2x), there was 0.12x GDP (€1.5 bn) in currency swaps available with the Nordics and 0.2x in committed credit lines. So short term national liquidity was about 0.35x GDP…. versus 7.5x GDP in FX liabilities in financial sector exposure! (Yes, some of this was long duration but not 7.15x GDP's worth!)

Kaupthing appeared potentially viable as a going concern and had received an 80 billion ISK loan from the government on October 6 to meet short financing. However, via its UK branch (Icesave), it had 1,200 billion ISK in liabilities (deposits) and as branch (i.e. not a subsidiary) the liability for depositor protection lay with the Icelandic state. CBI comments that the Icelandic state would not meet these obligations led to the UK using antiterrorist laws to seize the UK assets of the Icelandic banks triggering loan covenants for the group and Kaupthing was put into receivership on October 9.

Unsurprisingly, the big three had all passed "stress tests" only a few weeks earlier by the (Icelandic) FSA - there was no systemic test of the overall financial system or a proper liquidity simulation in the stress tests. The banks in theory were adequately capitalized. However, the equity was of poor quality as the collateral used to underpin the equity was often equity from related parties. In some cases, loans to third/connected parties were used to finance purchases of the bank’s own shares, i.e. effectively banks were lending money to buy shares in themselves, with those shares being the only collateral!? For example, Kaupthing Bank ultimately financed a large portion of Gnúpur’s shares in Kaupthing itself.(Clearly, the scope for abuse in manipulating one's own share price by doing this is high.) Banks would also invest their own equity alongside investments of their main borrowers completely blurring the lines between creditor and debtor. In mid-2008 weak equity amounted to just above 20 % of the capital base of Glitnir (i.e. related party shareholdings etc), stripping out intangibles and the weak equity base was about 45% of the capital base! Kaupthing, meanwhile, was happy to mark up assets it bought at inflated prices, which then contributed to its capital cushion (Olam anyone?).

The banks' balance sheets were 11x GDP with their FX exposure about 7.5x GDP. Meanwhile, the CBI's reserves were about 21% of GDP (i.e. 0.2x), there was 0.12x GDP (€1.5 bn) in currency swaps available with the Nordics and 0.2x in committed credit lines. So short term national liquidity was about 0.35x GDP…. versus 7.5x GDP in FX liabilities in financial sector exposure! (Yes, some of this was long duration but not 7.15x GDP's worth!)

AFTER EFFECTS

FX & CAPITAL CONTROLS

The ISK promptly tanked on the nationalisation of the banks - it troughed at roughly 50% vs. pre-crisis levels against the USD. On a more practical level, the implosion of the ISK made FX loans incredibly burdensome. Icelanders were big into JPY and CHF loans for automobiles and to a lesser degree mortgages and the CHF appreciated 107% against the króna in 2008 and the JPY 145%.

Iceland has the smallest floating currency in the world (other countries the size of Iceland either do not have their own currency, e.g. Estonia, Luxembourg, Malta, or peg to another country, e.g. Barbados, Bahamas, Brunei, Latvia, Maldives etc.) and the government implemented currency controls in October 2008 on worries that any FX reserves would be totally drained due to non-residents liquidating large holdings of krona-denominated bonds and deposits (about 30% of GDP).

Foreign aid was necessary to staunch the ISK's free fall and overseas FX swap lines with overseas central banks and an IMF, Nordic bailout in November 2008 made FX available to pay for imports that the Icelandic economy needed but was unable to produce. (At one point in October Russia was about to offer a $5.4bn bailout but this freaked out the EU significantly that it prodded the IMF and Nordics into gear.)

Iceland has applied to join the EU (accession negotiations are currently underway) with a view to adopting the euro as quickly as possible. This would significantly lower FX and inflation volatility for traded goods (nearly half of Iceland’s external trade is with countries in the euro area or pegged to it), however, the actions of its banks in fxcking around with the CBL and ECB with love letters and their Dutch and UK saving bank subs/branches haven't enamoured it to the powers that be.

Iceland has applied to join the EU (accession negotiations are currently underway) with a view to adopting the euro as quickly as possible. This would significantly lower FX and inflation volatility for traded goods (nearly half of Iceland’s external trade is with countries in the euro area or pegged to it), however, the actions of its banks in fxcking around with the CBL and ECB with love letters and their Dutch and UK saving bank subs/branches haven't enamoured it to the powers that be.

In an April 2011 referendum, Icelanders voted against an agreement to reimburse the UK and Netherlands governments for the compensation payments (plus interest at 3.0-3.3% per annum) that they had made to local depositors in Icesave branches of the failed Icelandic bank, Landsbanki. This agreement would have increased Iceland’s net general government debt by less than 2% of GDP. The estimated impact was modest owing to a high expected recovery rate from the assets of the Landsbanki estate (they are expected to cover about 99% of priority claims). Unsurprisingly, Holland and the UK aren't supporting an Icelandic bid to join the EU.

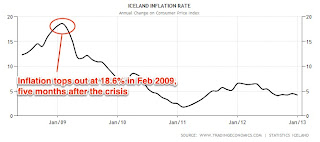

INFLATION

Inflation was relatively mild in Iceland during the boom years (mid-single digits), albeit significantly above the CBI's 2.5% target. The strong ISK also masked inflationary pressures as it made imports seem cheaper than otherwise and aggravated the current account deficit. However, once the krona and banks collapsed inflation spiked as importers were forced to pass on price rises in ISK to consumers. Moreover, given the widespread inflation indexing of mortgages (and use of loans in foreign currencies) many Icelandic households experienced a large increase in their debt levels.

Inflation though topped out 4-months after the onset of the crisis in January 2009 at 18.6% and then came rapidly down. FX stability helped bring inflation back into check, which was achieved via capital controls and, at least initially, the maintenance of interest rates at high levels. (Policy rates were high going into the crisis and from around 15% moved up to 18% before being loosened quite dramatically.)

Inflation though topped out 4-months after the onset of the crisis in January 2009 at 18.6% and then came rapidly down. FX stability helped bring inflation back into check, which was achieved via capital controls and, at least initially, the maintenance of interest rates at high levels. (Policy rates were high going into the crisis and from around 15% moved up to 18% before being loosened quite dramatically.)

As an aside, its interesting how people's expectations/forecasts often overestimate inflation in their lives (I remember one strategist - and actually normally an astute observer - flagging rising Japanese public expectations back in 2006/7 as evidence of the country shifting towards inflation.That actually never occurred.)

CURRENT ACCOUNT

The large current account deficits Iceland ran during the boom years were eliminated, although are still pretty large. The turnaround was/is mainly driven by the sharp import contraction. Export growth also contributed to the turnaround (aided by the currency depreciation and the new aluminum smelting capacity that was brought online), Iceland’s exports are highly concentrated in two industries: aluminium and marine/other fish products.

UNEMPLOYMENT

Unemployment rose and then topped out at 9.3% about a year and half after the crisis it has since stabilised around 5%, which is high by Icelandic standards. Average hours worked fell and wages adjusted quickly to the crisis, falling by 6¾ per cent in real terms in the year to April 2009, with the fall being much more marked in the private – than the public sector. The country also experienced very high emigration (the highest actually among Ireland, Iceland and Latvia).

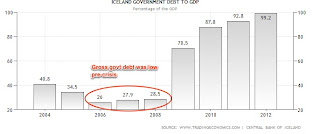

GOVT DEBT

Before the crisis, gross government debt was below 30% of GDP but started to balloon. The large fall in output (and thus taxable base) and support to the banking sector contributed to the increase in public debt (bank support boosted Icelandic public debt by about 20% of GDP). However, the government plans to achieve a primary budget surplus of at least 3% of GDP in 2013 and to increase it gradually in the following years and to restore public finances the government is implementing a fiscal consolidation programme agreed with the IMF (there is a decent amount of low hanging fruit - reversing earlier tax cuts, public sector payrises also outpaced the private sector etc.). The authorities plan to increase gradually the primary surplus beyond 2013 to bring the gross government debt-to-GDP ratio to below 60% of GDP. The government could also reduce gross debt by realizing its claims on the new banks when that becomes feasible.

FINANCIAL SECTOR RESTRUCTURING

FINANCIAL SECTOR RESTRUCTURING

Over 60% of Iceland’s external indebtedness was short-term duration, with 98% of this in the banking sector. In the run up to the collapse the CBI provided massive liquidity support to banks, which, by mid-2008, reached about 1/3 of GDP. Consequently, the CBI itself needed significant recapitalisation from the government due to bank-related losses. Losses on these loans and on bank securities held by the Treasury amounted to 13% of GDP! The CBI has since tightened rules on collateral eligible for loans.

With the collapse of the banks in October 2008, the Financial Services Authority of Iceland (FME) prepared the ground for the establishment of three new banks by carving out the old banks’ domestic operations, after their collapse, thus effectively separating domestic from foreign operations. Deposits were given first priority ahead of other claims and a blanket guarantee of all domestic deposits (by declaration, not law) prevented a run on the banks.

The Resolution Committees of the failed banks, Kaupthing and Glitnir, on behalf of their creditors, decided to recapitalise and become majority owners of the new Arion Bank and the new Íslandsbanki. The Icelandic state became the majority owner of Landsbanki, with the Resolution Committee taking a 20% stake.

The big three's assets were written down by 60%. The international businesses remained with the failed old banks for winding up. The division was complicated affair, mainly due to what the ‘fair value’ of the defaulted banks' assets were when they were transferred to the new, post-crisis banks. Restructuring of most of the financial institutions that failed in the wake of the global financial crisis was completed by the end of 2010.

All three new banks were recapitalised with strong capital ratios – in excess of 16% of all assets (in fact, most are above 20%) – and are 90% funded with deposits. Legislative reforms were implemented, including stricter rules on internal auditing responsibility and qualifications, increased responsibilities for boards and management, strict regulation of bonus pay, golden handshakes and golden parachutes.

The government also had to inject capital equivalent to 2.1% of GDP into the HFF to offset losses in its loan book. With the exception of the state-owned HFF, the Icelandic authorities imposed losses first on shareholders and subsequently on non-priority (i.e., non-deposit) unsecured creditors. This limited the direct impact on net government debt of restructuring financial institutions to around 5.9% of GDP, reflecting the cost of recapitalising the banks (3.8% of GDP) and the HFF (2.1% of GDP). This approach has strengthened market discipline, as shareholders and unsecured non-priority creditors have few grounds for expecting government bailouts to resolve financial institutions, which should reduce the incentives to pursue risky strategies and hence the probability of future financial crises.

Corporate debt restructuring proceeded slower than anticipated at first but was largely finalised in early 2012.

Finally, it is also worth reflecting on the fact that Iceland was able to return to international capital markets in June 2011 by issuing treasuries. This is remarkable as it still maintains strict capital controls and let its banks default on their foreign liabilities. It goes to show (depending on your viewpoint) that even the most hopeless cases can be rehabilitated or that markets just have incredibly short memories... or a bit of both!

Finally, it is also worth reflecting on the fact that Iceland was able to return to international capital markets in June 2011 by issuing treasuries. This is remarkable as it still maintains strict capital controls and let its banks default on their foreign liabilities. It goes to show (depending on your viewpoint) that even the most hopeless cases can be rehabilitated or that markets just have incredibly short memories... or a bit of both!

To Whom It May Concern

ReplyDeleteATTN,

Are you in need of a loan or Investment funding ? we give out all kinds of loans with a very low interest rate of 2%. Contact SKY GROUP PLC For more info, Do contact him with your detailed loan proposal

TYPES OF LOANS.

Auto Loans

Mortgage loans

Business Loans

Personal Loans

Real Estate Loan.

REQUIRED INFO.

1.Full Name:

2.Loan Amount Needed:

3.Loan Duration:

4.Country:

5.Mobile No:

Contact Person:Mr. Paul Fredrick

Position: Manager

Email: skygroupplc@gmail.com

© 2017 SKY GROUP PLC

Hello Everybody,

DeleteMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Hello Everybody,

My name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Are You Looking for a loan urgently? Would you like to settle your bills and Purchase property (Investment loan)/ Building loan? I can guarantee you 24 hours loan approval We are a world class Investment company offering all kinds of financial services with flexible repayment terms and a timely closing schedule.Email- (creditloan11@gmail.com)

ReplyDeleteThank you.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(creditloan11@gmail.com) Thank you.

Are you a business man or woman? Do you need funds to start up your own business? Do you need loan to settle your debt or pay off your bills or start a nice business? Do you need funds to finance your project? We Offers guaranteed loan services of any amount and to any part of the world for (Individuals, Companies, Realtor and Corporate Bodies) at our superb interest rate of 3%. For application and more information send replies to the following E-mail address: standardonlineinvestment@gmail.com

ReplyDeleteThanks and look forward to your prompt reply.

Regards,

Muqse

GOOD DAY AND WELCOME TO STANDARD ONLINE FINANCE LTD

ReplyDeleteDo you need 100% Finance? I can fix your financial needs with a lower back problem of 3% interest rate. Whatever your circumstances, self employed, retired, have a poor credit rating, we could help. flexible repayment, Contact us at: standardonlineinvestment@gmail.com

Apply now for all types of loans and get money urgently!

* The interest rate is 3%

* Choose between 1 and 30 years of repayment.

* Choose between monthly and annual repayment plan.

* Terms and conditions of the flexibility of loans.

Regards,

Mr. Abdul Muqse

GOOD DAY AND WELCOME TO STANDARD ONLINE FINANCE LTD

ReplyDeleteDo you need 100% Finance? I can fix your financial needs with a lower back problem of 3% interest rate. Whatever your circumstances, self employed, retired, have a poor credit rating, we could help. flexible repayment, Contact us at: standardonlineinvestment@gmail.com

Apply now for all types of loans and get money urgently!

* The interest rate is 3%

* Choose between 1 and 30 years of repayment.

* Choose between monthly and annual repayment plan.

* Terms and conditions of the flexibility of loans.

Regards,

Mr. Abdul Muqse